Good morning and welcome to Insider Finance. I'm Dan DeFrancesco, and here's what's on the agenda today:

- Here is where the biggest hedge funds – from Point72 to Millennium – stand on crypto investing.

- Women dealmakers faced the brunt of burnout from the pandemic. Carlyle's Ashley Evans detailed how firms can fix that.

- Sales professionals at asset manager are mostly white males, but one recruiter has a tool to change that.

Like the newsletter? Hate the newsletter? Feel free to drop me a line at [email protected] or on Twitter @DanDeFrancesco.

Hedge funds' biggest names – from Dalio to Cohen to Englander – are embracing crypto. Here's where the most influential managers stand.

Though there are still some holdouts – like Ken Griffin's Citadel – the crypto space has slowly become more accepted by top managers.

Here's what some of the biggest hedge fund managers are doing.

Women dealmakers bore the brunt of pandemic burnout. A private-equity exec explains how the industry can reset and fix the problem.

New data shows that 60% of women dealmakers faced pandemic burnout versus 41% of men. We spoke with Carlyle's Ashley Evans, who said firms must fix "structural inequities" to spur progress. Here's what else she told us.

The people asset managers hire to sell their funds are mostly white and male. A Wall Street recruiter has a plan to change that.

According to new diversity data compiled exclusively for Insider, most sales professionals at asset managers are white men. Get the full scoop from our exclusive report.

Greg Fleming's Rockefeller is staffing up and eyeing more M&A to take its family-office business to the next level

More acquisitions and hires are on the way for Rockefeller, said executive Heather Flanagan. Here's what's next for the $75 billion firm.

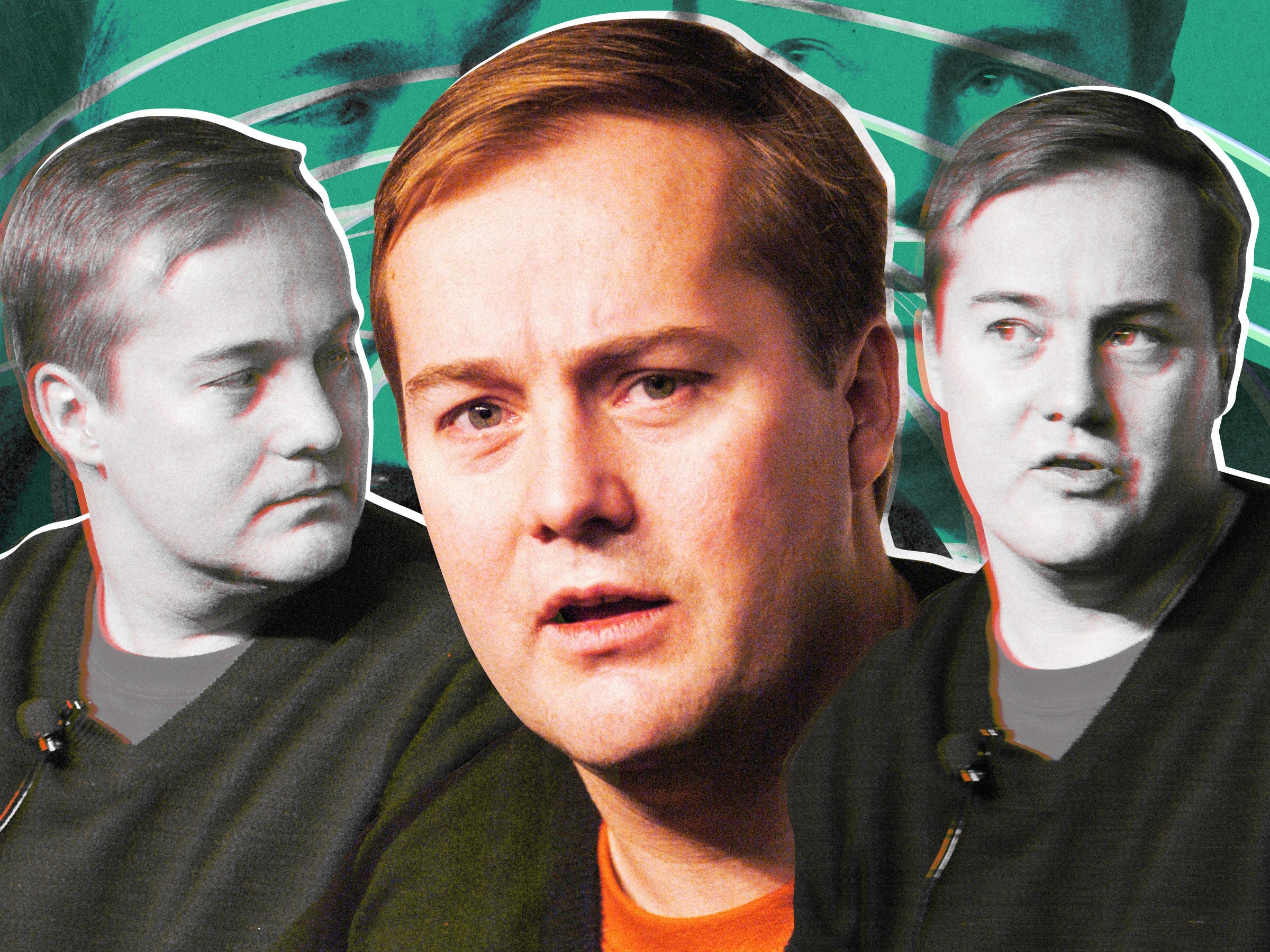

50 founders and VCs dish on what it's like to work with Jason Calacanis, Silicon Valley's most polarizing, Howard Stern-inspired investor

For many young entrepreneurs with dreams of launching a startup, Calacanis is the first stop. We spoke with dozens of people close to him to learn what it's like for a generation of young aspiring entrepreneurs heeding his call to change the world. Take a look at what we found.

A hedge fund founder who quit his job to start a healthy food company shares his best advice for anyone burned out and considering leaving Wall Street to pursue their passion

Jason Karp said that since leaving the hedge-fund world in 2018, some of the industry's top founders have since called to get his advice on leaving. This is what he tells them.

Odd lots:

MDC Partners' proposed merger with Stagwell is facing growing investor opposition (Insider)

Fed to Sell Corporate Bonds and ETFs Acquired During Covid-19 Crisis (WSJ)

TPG Capital Taps Goldman Sachs Lawyer as New General Counsel (Bloomberg)